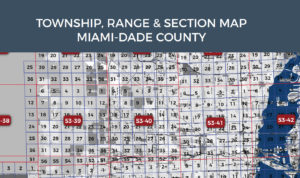

We just finished creating an updated version of our “world famous” Township, Range & Section Map for Miami-Dade County using free GIS Data from Miami-Dade County and QGIS.

Download it here for a printable copy [DCRE 2018 TRS Map] Or invite us out for lunch and we’ll bring you an 11 x17 poster-sized version once they arrive.

Tom was quoted in the Miami Today, today, in a story about the tax implications of Miami’s priciest Office Towers.

Tom was quoted in the Miami Today, today, in a story about the tax implications of Miami’s priciest Office Towers.

“Thomas Dixon of Dixon Commercial Real Estate finds the largest office buildings contributing about S51 million to Miami-Dade in 2017 property taxes.

Reviewing the 20 largest multi-tenant properties within Miami-Dade, findings show how the investment per square foot of rentable space changed from 2016 to 2017. Mr. Dixon sees factors such as a building’s age and whether it was recently sold as influencing its property taxes.”

You can read the full article online if you have a subscription.

Another year and another massively successful CIASF Industrial Market Report. We’d like the thanks all those that helped us pull it off. Especially Sebastian Juncadella and Fairchild Partners for his part in the presentation.

For any who need a copy, you can download the full report on here.

We were also quoted in the Real Deal’s coverage of the event. Which you can read on their website. Pay no attention the fact that they called in the 2017 report.

At this time it does not appear that the County will be extending the Sept 19th, 2017 deadline for filing tax assessment petitions.

Because Hurricane Irma has disrupted our normal business hours, we will be preemptively filing on approximately 500 cases for clients that we worked with last year.

We will try to include any and all new clients that wish to appeal their tax values for 2017. However, we may have to file later than usual, but we should have good cause to get the hearings granted as long as they are filed in the next week or two.

Please continue to use our online form to fill out information on new properties not in our database, or email us directly.

You can also call our offices at 305.443.4966, but we may not be available until Monday the 18th due to lack of power and internet.

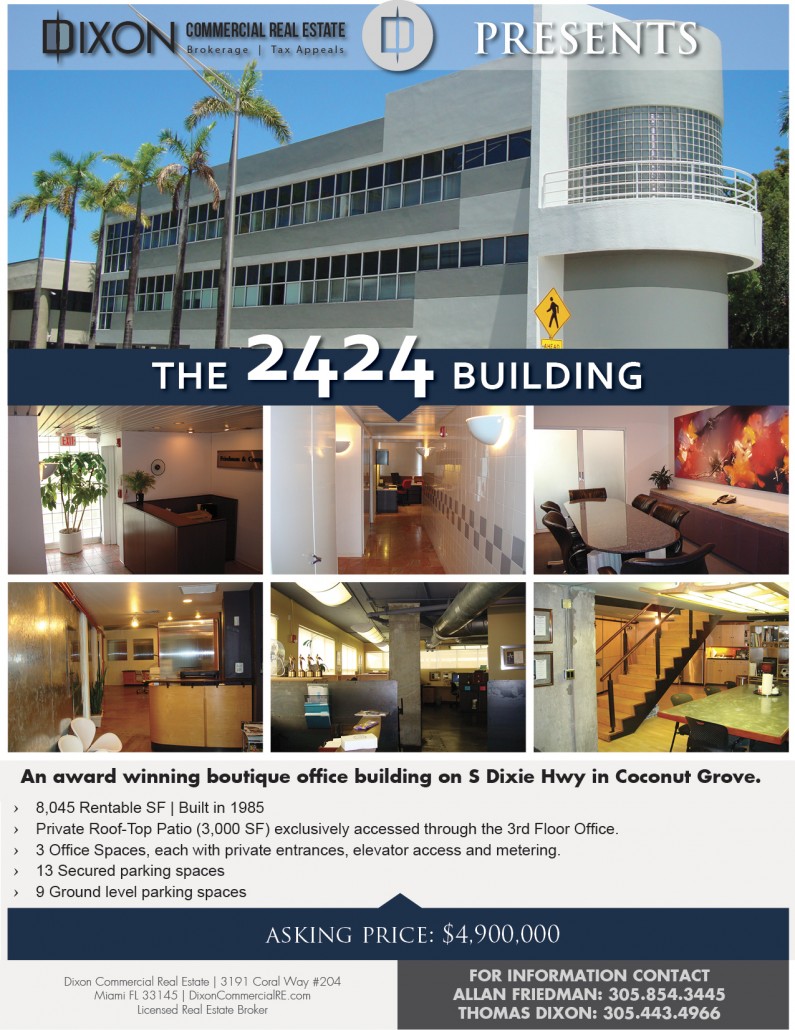

Did you know The 2424 Building has been featured in Miami Vice?

Crockett and Tubbs Visit The 2424 Building

Watch the Full Episode “Forgive Us Our Debts”

on or

If you live in Florida and own property, you will receive a TRIM (Truth in Millage) notice in the next 4 to 6 weeks. This notice will give you an estimate of the real estate taxes that the property must pay, based upon the assessment and proposed millage rate.

The assessment (value) is established each year by the County Property Appraiser using mass appraisal techniques. The millage rate is based on funds the city and county government need to operate, divided by the total values of all real property in the County. The real estate taxes for a property is then calculated by multiplying the assessment – say $100,000 times the millage rate of say 19 mills, which is really 1.9% or .019. This equals a tax of $1,900. I sometimes think that the term millage rate is used to confuse the taxpayer. It would be much clearer if it was expressed as a percentage of value. As in you’ll be paying about 2% of your properties value in taxes each and every year.

As a taxpayer, you are only obligated to pay your fair share. And if you think you are unfairly assessed there is something you can do about it.

Unfortunately the only part of the real estate tax equation which can be appealed is the assessment. However you are always welcome to attend the budget hearings to find out more about that process.

After you receive the TRIM notice, there is usually a period of 25 days to file an appeal petition if you wish to protest the assessment. Then, sometime in the next 12 months there will be a hearing before a Special Magistrate to debate the assessment. As a property owner, you can file the appeal and present your arguments before the Special Magistrate. However, many property owners have found that using a professional is much more effective.

With our 30 plus years of combined knowledge of South Florida real estate valuations as estate brokers, professional appraiser, teacher and economic analysts, we are well equipped to represent property owners in the successful appeal of real estate tax assessments.

WE CAN MAKE SURE THAT YOU ARE ONLY PAYING YOUR FAIR SHARE OF REAL ESTATE TAXES.

Q: I just received my tax bill and the county now offers the option to pay only 75% of the tax bill. How much of my real estate tax bill should I pay?

A: The simple answer is 100%, and not the 75% option.

Here’s a few reasons why this is bad for our clients and tax payers in general.

- After the appeal process you will still need to pay the difference between the original bill and the revised bill, PLUS INTEREST at 1% per MONTH.

- If the time it takes for them to schedule the hearing exceeds (in months) the percentage of savings achieved, you could be liable for a bill that is larger than originally listed even after winning the appeal. This is because on average the appeals don’t take place until almost a year after the petitioned get filed and sometimes closer to a year and half.

- We would need to achieve a reduction of more than 25% to negate any interest penalties that have accrued. While this has happened in the past in some cases, it is not the norm and shouldn’t be expected.

- You can actually make money! To offset the INTEREST PENALTY the law includes a provision that the petitioner will EARN the 1% per month INTEREST if the County must issue you a refund because of a reduction.

- Banks do not like this. A few clients have told of us issues with their banks thinking they were in default when the county showed an outstanding balance on the account before the appeal hearing had been scheduled.

- Lastly, it makes it very confusing, for all involved, for us to have to send you a bill for a 10% reduction, when you still owe the county 15%, plus interest at 1% per month for 8 months. We’ll look bad, you’ll feel cheated when in actuality we did save you quite a few dollars.

If you’d like to see the exact amount due at any time you may visit the Miami-Dade Tax Collectors Search Page

Dixon Commercial Real Estate

3191 Coral Way, Suite 204

Miami FL 33145

305.443.4966

info@dixoncommercialre.com

Licensed Real Estate Broker